The TinySeed Investment Thesis

We believe investing broadly into the earliest stages of the Independent SaaS market — specifically, the set of B2B SaaS companies who are not necessarily reliant on traditional venture capital — can provide venture returns with less than venture risk.

In this article, we give an overview of :

Why investors are making the mistaken assumption that the only way to achieve “venture type” returns means your portfolio has to be solely focused on unicorns. (Jump to section)

Why we believe Independent B2B SaaS company outcomes are power law distributed, and why investing broadly is a superior strategy in that environment. (Jump to section)

How our equity/dividend share instrument allows for meaningful returns even in a portfolio that lacks outlier outcomes (while still retaining the possibility of those outlier returns.) (Jump to section)

Why TinySeed is uniquely positioned to execute on this thesis and how you can invest with us. (In broad strokes: Our deal flow, our expansion plans, and our team.) (Jump to section)

We’ve shortened the full piece here, but if you’d like access to the full 6000+ word memo including more detailed analysis, please fill out the form on our Invest page.

Truncated thesis can be read below:

Non-venture backed B2B SaaS companies are a huge blind spot when it comes to investors and tech press

B2B SaaS companies have extremely attractive economic characteristics, including common gross margins of 80-90%, predictable revenue and customer acquisition costs, and net margins at 25-50% for companies over $1-3m ARR. They also quite often do not even fully deploy the capital raised prior to IPO: PagerDuty raised $174m, but had $128m in cash left when it went public; Slack raised $1,390m, but had $841m in cash left when it went public; and Zoom, which had more cash in the bank than it raised when it went public (!)

Providing growth capital to these kinds of companies is the bread and butter of traditional software focused venture capital (VC) firms, but early stage venture investment in B2B SaaS focuses on the small subset of companies aiming for IPOs from the outset, implying that only these can provide “venture type” returns.

High profile investors have claimed that you should “limit yourself to opportunities that could be $10 billion companies.” While extreme, the idea that you can only make venture returns by chasing unicorns is not new.

Capital invested vs. deals for seed stage. Deal sizes have gone up while capital available has stayed relatively the same for the last seven years.

B2B SaaS investors (along with VCs in general) have operated in this manner for a while, which has resulted in funding getting concentrated into a smaller and smaller subset of companies.

Competition from capital chasing a small number of companies has pushed valuations up, meaning fewer and fewer companies have a large enough potential to be worth investing in, pushing valuations even higher, further shrinking the set of companies deemed investable.

This unicorn-chase ignores the universe of high growth B2B SaaS companies that didn’t necessarily start out with the intention of becoming unicorns, nor were they geared for growth at all cost with the traditional multiple rounds of dilutive venture capital that entails.

Instead, these are what we refer to as “Independent SaaS companies.” These are companies that may have bootstrapped or taken a small amount of seed capital early on, and then grown on customer revenues from there.

We’ve written a full article about our findings, which you can read here. In short: We found 3158 publicly announced acquisitions, and over 93% of acquisitions did not get any mainstream technology press mentions and less than a third had taken traditional, multiple rounds of venture capital.

This very large number of Independent SaaS companies are assumed by most venture capital investors as being incapable of consistently providing the kinds of returns required by LPs, as they are not geared for hyper growth at all cost from the start.

We believe this assumption is incorrect.

Power law environments and why investing broadly is a superior strategy

“Spray and Pray” is not a term of endearment in most investing circles, but in specific environments where the distribution of outcomes follows a power law (specifically – an “ α < 2 power law”), there is strong evidence that a broad investment strategy is superior.

Anecdotal evidence for this is reasonably abundant. Firms like YCombinator effectively index into the early stage traditional venture market, even if they don’t explicitly advertise as such. Firms like 500 Startups have been much more vocal about their view of the superiority of this approach, and several Harvard Business School case studies support their assertions, as do the performance of their funds.

AngelList published an analytical study of possible portfolio construction strategies based on 684 deals showing that:

“…at the seed stage investors would increase their expected return by indexing into every credible deal, a finding that does not hold at later stages”

An empirical follow up study from the same author (and committed LP in TinySeed Fund 2), using data from real investor portfolios on the AngelList platform found clear evidence backing this assertion:

“We find that having investments in more companies tends to generate higher investment returns. Our results are consistent with recent theoretical models that suggest the returns from early-stage venture investing follow an α < 2 power law.”

“We find that having investments in more companies tends to generate higher investment returns. Our results are consistent with recent theoretical models that suggest the returns from early-stage venture investing follow an α < 2 power law.” [7]

This does not make intuitive sense for many investors, yet follows quite persuasively from the properties of power laws, specifically ones where the α (the exponent of the power law) is less than 2.

A power law with α less than 2 has an unbounded mean. This means that the regret an investor could have for missing a winning early stage investment is theoretically infinite. Theoretically infinite regret is not a particularly helpful concept, so consider the corollary to this: With a power law with an alpha less than two, the largest expected return multiple per investment increases faster than the number of investments made.

The graph to the right illustrates this concept. The x-axis is the number of picks and the y-axis the largest expected return multiple. The green line shows (for alpha = 1.9) the effect of increasing the number of investments vs the largest expected return multiple per investment. This illustrates that fund performance is likely improved with a larger number of investments. The lower the alpha, the more pronounced this trend becomes (i.e. the curve is steeper for alpha = 1.75 than for 1.95).

Independent B2B SaaS company outcomes are power law distributed

Does this also apply to Independent SaaS companies? Or is there something specific about traditional venture backed companies that does not apply to B2B SaaS companies that (at least initially) do not set out to become Unicorns or Decacorns?

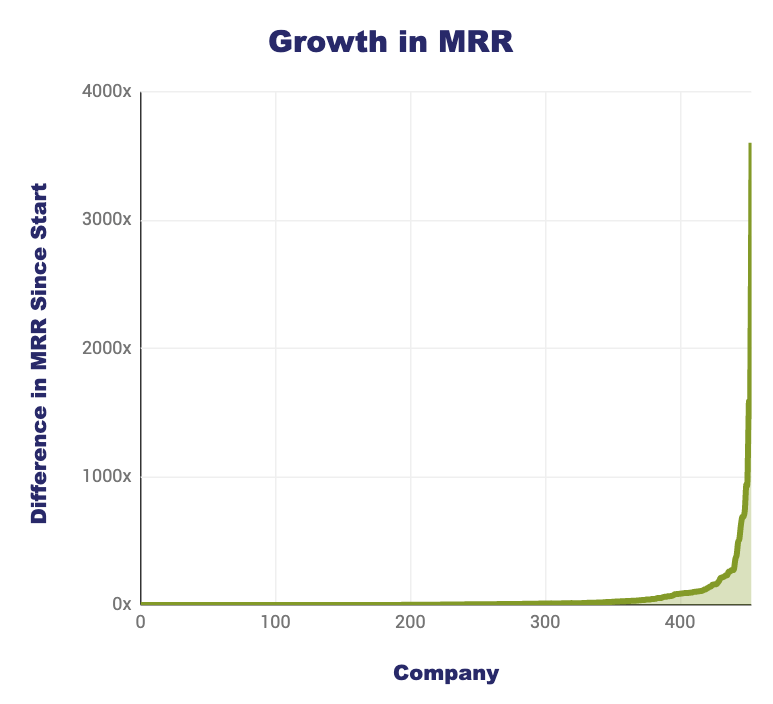

We decided to use our unique access to the early stage Independent SaaS market to find out. We obtained up to 5 years of monthly revenue (MRR) data from a set of ~500 SaaS companies with starting revenues between $500 MRR and $15k MRR, and at least 12 months of operating history (the average operating history was 47 months).

This graph shows the ratio between starting MRR and latest MRR of the ~500 companies (those whose MRR had declined were set to zero). This is a relevant measure, as the vast majority of company outcomes (and how we value our companies for analysis purposes) are closely tied to the MRR of the company (along with growth & profit, which we’ve not considered here).

We found that the best fit for this distribution was a power law with alpha ~= 1.7. This is a strong power law, and speaks to the huge variability in the growth rates in the early years of Independent SaaS companies.

This is something we have observed in our own portfolio already, and supports the thesis that investing as broadly as possible into Independent SaaS companies should increase a fund’s expected returns vs a more selective strategy.

Why invest early using an equity/dividend share instrument?

If you are convinced that the Independent B2B SaaS market is power law distributed with alpha < 2, and that in such an environment broadly indexing into the market is a superior strategy, the question remains – why invest early and why are we choosing to innovate with the investment instrument we’re using?

Going early is the only way to invest broadly

If you want to invest broadly, there are two main reasons for going early: valuations and lack of access to fractional ownership in later stages.

Valuation is an obvious reason. As discussed previously, B2B SaaS companies in general are quite capital efficient and can become huge on limited (or no) growth capital. That means later stage valuations are likely to remain high, and with a bounded amount of capital the ability to broadly index becomes infeasible.

“When I was considering taking funding from TinySeed one of the biggest areas of concern was that I’d suddenly feel extra pressure and stress from having investors. Instead, the combination of having extra resources and the TinySeed support network (while keeping the flexibility of bootstrapping) has felt like a weight off my shoulders. Now that I’ve done it, it just seems like the obvious way to go. Hard to see doing it any other way.”

Furthermore, unlike in the public markets, where there is easy, liquid access to fractional ownership of any company desired, there is no liquid market for fractional ownership in later stage B2B SaaS. Later stage investors are likely to jealously guard allocations in these firms, so even if you could afford to broadly index at this stage, you would be unlikely to get the access needed to do so efficiently. The rise of non-dilutive revenue-based financing has also exacerbated this issue for later stage investors.

Finally, the higher valuations and lower growth rates of later stage startups means the expected outcome distribution changes fundamentally. It provides a higher alpha, and hence a broad indexing approach is no longer obviously superior.

Investing early using an equity/dividend share instrument allows for meaningful returns to investors even in a portfolio that lacks outlier outcomes, while still retaining the possibility of outlier returns.

Paying too high a valuation for your early stage investment will change the expected return of a broad-based indexing approach. Furthermore, as B2B SaaS companies are so capital efficient, an instrument like a SAFE, designed for the traditional venture capital trajectory of frequent successive fundraises, may fundamentally undermine the returns of an investor. If a company never raises additional funding, an instrument like an uncapped SAFE may never convert, effectively capping the investor return at 1x.

Obviously, there are ways around this (capped notes, etc.), but as we’re looking to back companies that are not currently deemed “venture backable”, we do not think that the optimal way to achieve this is to tweak investment documents designed for traditional venture.

Instead, we’re investing using a hybrid stock/dividend instrument that works roughly as follows:

We buy stock with a 1x liquidation preference and a side letter, where the founders agree to a reasonable salary cap (we are not particularly stingy here).

Anything above that salary cap should be kicked out as dividends, of which TinySeed participates pro-rata.

There is no redemption of stock or units associated with the dividend payments, as this would (severely) undermine expected returns for the fund given the power law outcomes of these kinds of companies, at the stage they’re in.

The interesting thing about this structure is that it can provide a decent return for investors even in the scenario where no outlier outcomes occur. Our analysis (based on the same data set of ~500 Independent SaaS companies used to show power law growth) shows that investing, using the above approach & valuation, into every deal that fit our criteria, but then throwing away any company that could even reasonably be considered an outlier outcome, we ended up with a very reasonable return of over 10 years. Adding in outliers, the returns are solidly in the upper quartile of venture funds (more details in the full memo.)

This analysis supports our thesis that a broad indexing approach into the very earliest stages of Independent SaaS companies is likely to perform well, and potentially very well. Of course, there was always the possibility of finding outlier outcomes among B2B SaaS companies, but the recent development of a healthy market for mid-level successes speaks to the “why now” of TinySeed’s investment strategy: only now is there an opportunity to achieve venture returns with less than venture risk.

Some of our current TinySeed investors:

Why invest via TinySeed?

We believe that an investor who invests broadly and early into the Independent B2B SaaS market is likely to do well, and has the potential to do extremely well. The question remains: Why not just invest directly using this approach?

We think most investors would be better off investing in TinySeed, rather than attempting to execute this strategy by themselves.

TinySeed has proven deal flow and pricing power advantage, a team with a unique combination of experience in the Independent SaaS market, aggressive plans to scale, and early evidence from Fund 1 to support our ability to land investments that grow very rapidly.

This combination of unfair advantages is hard to replicate, which means that investing in TinySeed is likely the best option for most investors looking for exposure to these types of early stage B2B SaaS companies. Our policy of not doing follow-ons, but instead facilitating these opportunities for our investors, also means TinySeed is a compelling way to get allocations in later stage deals if the investor desires.

Deal flow and pricing power

MicroConf Europe 2019 in Dubrovnik, Croatia.

TinySeed operates as part of MicroConf, the premier conference series (virtual and in-person) for Independent SaaS companies in the world. MicroConf also includes an extremely popular podcast (Startups for The Rest of Us) and TinySeed runs a year-long remote accelerator with a world-class group of mentors for its portfolio companies. This provides us with differentiated deal flow and strong pricing power.

As explained previously, investing broadly is a key part of our strategy. In order to effectively do that, an investor would need to have access to deal flow sufficient to achieve that goal. Fortunately, TinySeed has more inbound quality deal flow than we have funds to invest. In the last two application periods, we received nearly 1,600 applications, with the second application receiving slightly fewer applications but were higher quality. Given sufficient funds and an organization to support them, we would have liked to invest in at least 50 of these companies in each application period.

We believe that very few individual investors or other organizations could replicate this deal flow advantage.

Even if one could replicate our deal flow, an investor executing our strategy would need to avoid paying too high a valuation for it. Too high a valuation will hurt returns, both in the base case (no outliers) and in the expected case (some outliers). This makes sense, since at its core venture capital success is a function of buy price and sell price.

Several of our portfolio companies have informed us that they had higher valuation offers from other investors, but chose to go with us because of our reputation, the community in and around MicroConf, the appeal of our year-long remote program and the caliber of our mentors.

A team with unique experience in the Independent SaaS market

Rob Walling

TinySeed was founded by Rob Walling and Einar Vollset. Between them, they have operated, invested in, sold, brokered and advised Independent SaaS companies for over two decades.

Rob Walling founded Drip.com, an Independent SaaS company that sold to Leadpages in 2016. He has been teaching founders how to build, launch and grow startups for 15 years. He is the co-founder of MicroConf and the Startups for The Rest of Us Podcast (more than 10m downloads). He has published two best-selling books and been quoted in publications like The Wall Street Journal, Forbes, Entrepreneur and Inc.

Einar Vollset

Einar Vollset co-founded a YCombinator-funded startup that sold to Google in 2010, and is the founding partner of Discretion Capital, a sell-side M&A firm specializing in B2B SaaS companies between $1m and $25m ARR. He has represented dozens of B2B SaaS founders in sales of their businesses, including to private equity firms like Insight Partners. Previously he was a professor of Computer Science at Cornell University.

Aggressive expansion plans

Independent SaaS companies are being created across industries and geographies. Given our leadership in the Independent SaaS market, TinySeed is uniquely positioned to expand our model to invest in more companies and run more batches.

TinySeed eventually intends to expand our current program to invest in 100s of companies a year across three time zones – North America, Europe and APAC. The existing batches align with the flagship MicroConf US conference, and we intend to align the European and APAC batches with the MicroConf Europe and MicroConf Asia (launching in 2021) events. We have already landed Stripe and Basecamp as headline sponsors for these events.

Join us in our mission to invest broadly into the B2B SaaS market

Investors have been making the mistaken assumption that the only way to achieve “venture type” returns means your portfolio has to be focused on unicorns. We’ve shown:

Why investing broadly is a superior strategy, and why Independent B2B SaaS company outcomes are power law distributed.

Our equity/dividend share instrument allows for meaningful returns even in a portfolio that lacks outlier outcomes (while still retaining the possibility of those outlier returns.)

Last but not least, investing into the B2B SaaS market via TinySeed means you’ll have access to our deal flow and our team with unique experience in this market.